Navigating the Storm: How Afghan Business Copes With Turmoils and Strategies for Survival

|

Article Intro

Amidst profound political and economic turmoil, Afghanistan's business community demonstrates remarkable resilience. Local enterprises survive by leveraging trusted informal networks, utilizing alternative financial systems like hawala, and demonstrating extreme operational agility. The resurgence of Islamic finance provides a religiously-sanctioned framework for commerce in the absence of conventional banking. Businesses adapt their promotion through shopfront visibility, community ties, and digital tools like WhatsApp. Ultimately, survival hinges on fortifying core operations, managing liquidity with discipline, investing in local value chains, and, most critically, prioritizing stakeholder trust. This ingenuity offers a global blueprint for navigating hyper-volatility.

|

Introduction: The Unyielding Afghan Entrepreneur

The narrative of Afghanistan in the global consciousness is often dominated by political upheaval, security challenges, and humanitarian crises. Yet, beneath this turbulent surface thrives a force of remarkable resilience: the Afghan business community. For decades, through invasion, civil war, and shifting political regimes, local enterprises have not merely existed but have found ways to adapt, persist, and even occasionally prosper. The current environment, marked by the Taliban's return to power, international sanctions, the freezing of national assets, and a crippled banking sector, presents perhaps the most complex challenge yet. This article delves into the innate and learned survival strategies Afghan businesses employ, explores the growing role of Islamic business principles, and outlines a practical framework for local enterprises to navigate the ongoing turmoil.

The Landscape of Adversity: Understanding the Challenges

To appreciate the coping mechanisms, one must first understand the multifaceted nature of the crisis. Afghan businesses today grapple with a confluence of severe pressures:

1. Macroeconomic Collapse

The sudden halt of international development aid, which constituted over 40% of Afghanistan's GDP, triggered a profound economic contraction. High unemployment, plummeting purchasing power, and rampant inflation have decimated local markets.

2. Financial and Banking Paralysis

Sanctions and de-risking by international financial institutions have severed the country from the global banking system. This has led to a critical liquidity crisis, making it nearly impossible for businesses to access capital, transfer funds internationally, or engage in normal trade finance.

3. Political and Security Uncertainty

While large-scale conflict has diminished, security concerns persist. More critically, the lack of formal international recognition of the de facto authorities creates profound legal and operational uncertainties for businesses, hindering foreign investment and long-term planning.

4. Human Capital Flight

The exodus of educated professionals, technocrats, and skilled workers has created a significant brain drain, stripping businesses of critical managerial and technical expertise.

Despite this daunting reality, the bazaars remain open, goods are traded, and entrepreneurs continue to innovate. Their survival is a masterclass in contingency and grit.

Ingenious Coping Mechanisms in Action

Afghan businesses have developed a sophisticated, if informal, toolkit for survival. These are not strategies taught in business school but forged in the crucible of persistent instability.

1. The Primacy of Informality and Network Capital (Wasta)

The formal economy has largely retracted, giving way to a robust informal sector. Business is conducted on the strength of personal relationships and trust, often built over generations. The concept of "wasta" or social influence is a critical currency. Deals are sealed with a handshake, and disputes are resolved through local jirgas or shuras (councils of elders) rather than formal courts. This reliance on social capital reduces transaction costs and bypasses crippled bureaucratic systems. Supply chains operate on pre-existing trust networks, where goods are advanced on credit with the expectation of future payment, keeping commerce flowing even without formal banking.

2. Extreme Operational Agility and Diversification

The ability to pivot is not a strategic choice but a necessity for survival. Businesses have become adept at reading political and economic tea leaves. A company that once imported luxury goods may swiftly shift to dealing in essential commodities like flour, oil, and fuel. Others diversify their holdings across unrelated sectors—a single entrepreneur might have interests in transportation, agriculture, and retail to spread risk. This hyper-diversification ensures that if one sector collapses, others may provide a lifeline.

3. Liquidity Management and Alternative Finance (Hawala)

With the formal banking sector in crisis, the ancient hawala system has become the backbone of Afghan commerce. This informal trust-based money transfer system allows businesses to move funds domestically and internationally with speed, reliability, and relative anonymity. For local businesses, it is the only viable method for paying for imports and receiving payment for exports. Furthermore, businesses are hoarding cash (often in US dollars) and relying on internal capital generation, shunning debt due to its prohibitive cost and unavailability. Barter trade has also seen a resurgence in some local markets.

4. Digital Adaptation and Social Commerce

Despite challenges, Afghanistan has a growing young, digitally literate population. Businesses are leveraging this through social media platforms like WhatsApp, Facebook, and Instagram. These platforms serve as virtual storefronts, customer service channels, and marketing tools, allowing businesses to reach customers directly and maintain operations with minimal physical overhead. While e-commerce in its formal sense is nascent, social commerce is thriving, enabling trade to continue amid restrictions on movement and assembly.

5. Focus on Essentials and Import Substitution

With a sharp decline in disposable income, market demand has heavily shifted towards essential goods and services. Astute businesses have followed this demand. Furthermore, the difficulties and costs associated with imports have sparked a slow but noticeable push towards import substitution. There is growing interest and investment in local manufacturing of basic goods—from food processing and textiles to simple plastic products—that were previously imported. This not only caters to local demand but also conserves scarce foreign exchange.

Getting Noticed: Local Advertising and Promotion Strategies

In an environment where traditional mass media advertising is often inaccessible or ineffective due to cost and reach limitations, Afghan businesses have developed creative, context-appropriate methods to reach their customers.

Traditional and Physical Advertising Methods

Shopfront Signage and Visual Merchandising: In the bustling bazaars, a business's storefront is its primary advertisement. Brightly painted signs in Dari and Pashto, often accompanied by visual representations of the products sold (e.g., a picture of a bicycle for a repair shop), are crucial for attracting walk-in customers. The strategic display of goods spills out onto the street, creating a vibrant and inviting atmosphere.

Word-of-Mouth and Community Reputation: This remains the most powerful and trusted form of advertising. A business's reputation for quality, fair prices, and trustworthiness is built over years and spread through customer networks. A recommendation from a family member or community elder carries more weight than any billboard.

Local Billboards and Banners: In urban centers like Kabul, Mazar-i-Sharif, and Herat, businesses use locally produced billboards and banners placed along major roads and roundabouts. These are particularly common for mobile phone companies, medical clinics, and construction material suppliers.

Distribution of Business Cards and Flyers: Despite being a low-tech solution, the distribution of business cards and simple flyers remains effective, especially for service-based businesses like tailors, tutors, and technicians. These are often distributed through existing customer networks or left at related businesses.

Digital and Mobile-First Promotion

WhatsApp Business as a Primary Channel: For a vast majority of small and medium enterprises, WhatsApp has become the de facto digital platform. Businesses create broadcast lists to announce new stock, promotions, and price changes. They use status updates as a mini-catalog and manage customer service through private chats. Many businesses now list their WhatsApp number as their primary contact.

Facebook and Instagram Pages: Businesses with slightly more digital savvy maintain active Facebook and Instagram pages. They use these platforms to post photos and videos of their products, share customer testimonials, and announce their location. Facebook's local marketplace groups have also become a popular venue for buying and selling goods.

SMS Broadcasts: For businesses with a captured customer database (like pharmacies or clinics), bulk SMS messaging is a direct and effective way to reach customers, especially those in areas with limited internet access. Messages typically announce new arrivals, special offers, or holiday greetings to maintain top-of-mind awareness.

Telegram Channels: Similar to WhatsApp, Telegram is gaining popularity for its channel feature, which allows businesses to broadcast messages to a large number of subscribers without revealing phone numbers. This is particularly useful for news outlets, wholesalers, and professional services.

|

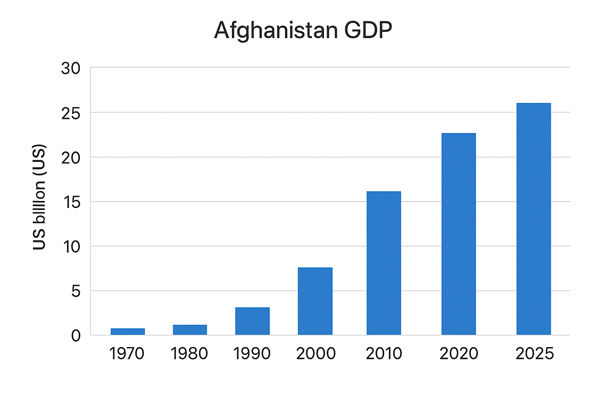

| Afghanistan GDP from 1970 to 2025 |

|

A significant yet often overlooked online promotion method for Afghan companies is the use of local business directories. In the absence of a robust Google Maps ecosystem, platforms like local business listing websites and, more commonly, dedicated Facebook pages and groups have become the de facto digital directories. Businesses ensure their presence in these community-run or commercially operated lists, which are often categorized by trade—from construction materials and electricians to specific food items. Being listed provides a crucial layer of legitimacy and makes a business discoverable to new customers who are actively searching for a particular service within their city or region.

Community-Integrated Marketing

Sponsorship of Local Events: Businesses build goodwill and visibility by sponsoring local community events, such as sports tournaments, religious ceremonies (like Nowruz or Eid), or school events. This positions the business as a community pillar rather than just a commercial entity.

Partnerships with Mosques: For hyper-local targeting, some small businesses arrange for announcements to be made at local mosques after prayers, a practice that guarantees reach within a specific neighborhood.

Vehicle Branding: Trucks, vans, and rickshaws are often painted with business contact information and services, turning them into mobile advertisements that traverse the city and beyond.

The Resurgence of Islamic Business and Finance

In the context of a redefined legal and social framework, Islamic business principles have moved from a parallel system to a central tenet of the commercial environment. This offers both challenges and opportunities for local businesses.

Core Principles in Action:

Prohibition of Riba (Interest): This is the most significant factor. The conventional interest-based banking model is now religiously and legally prohibited. This has accelerated the search for Sharia-compliant alternatives for financing and investment.

Asset-Backed Financing and Risk-Sharing: Islamic finance emphasizes that money must be tied to a real, tangible asset or service. Models like Murabaha (cost-plus profit sale) and Mudaraba (profit-sharing partnership) are becoming more relevant. For example, instead of taking a loan to buy machinery (which would involve interest), a business might enter a partnership where an investor provides the capital for the machinery in exchange for a pre-agreed share of the profits generated.

Ethical and Social Responsibility: Islamic business ethics stress fair trade, transparency, and the avoidance of Gharar (excessive uncertainty or speculation). Businesses are expected to deal justly with employees, customers, and suppliers. This aligns well with the existing culture of trust but now carries a stronger religious imperative.

Practical Implications:

For the average Afghan business, this means:

Seeking Alternative Funding: Entrepreneurs are increasingly looking towards Musharaka (joint venture) and Mudaraba arrangements to raise capital, pooling resources with family, friends, or other investors under Islamic contracts.

Adapting Transactions: Sales and purchase agreements are being framed to comply with Islamic principles, ensuring clear terms and asset-backing.

The Formalization of Hawala: While hawala has always operated on trust and avoided interest, it is now being viewed through a more formal Islamic lens, with some networks explicitly branding themselves as Sharia-compliant financial service providers.

While the formal infrastructure for a full-fledged Islamic banking sector is still under development, the underlying principles are actively shaping commercial behavior and providing a religiously-sanctioned framework for economic activity in the absence of conventional finance.

A Strategic Framework for Sustained Survival and Future Growth

While the coping mechanisms are impressive, a more structured approach can enhance resilience and position businesses for recovery when conditions improve.

1. Fortify the Core

In uncertain times, it is prudent to return to the business's fundamental strengths. Identify the core products or services that have consistent demand, even in a recession. Streamline operations to protect these revenue streams, shedding non-essential costs and complexity. This "back to basics" approach ensures stability.

2. Build Financial Shock Absorbers

The liquidity crisis demands extreme financial discipline. Businesses must:

- Prioritize Cash Flow: Manage receivables aggressively and extend payables where possible through trusted relationships.

- Maintain Multiple Channels: Cultivate relationships with several reliable hawaladars to avoid reliance on a single channel.

- Stockpile Critical Inputs: Where feasible, maintain strategic reserves of essential inventory or raw materials to hedge against supply chain disruptions.

3. Invest in Localized Value Chains

The push for import substitution represents a significant opportunity. Businesses should actively explore backward integration and partnerships with local producers. Investing in agriculture, small-scale manufacturing, and local services reduces dependency on volatile international supply chains and taps into nationalist sentiment favoring local products.

4. Embrace Digital Transformation Pragmatically

A basic digital presence is no longer a luxury. Businesses should:

- Utilize free or low-cost digital tools for accounting, inventory management, and customer relationship management.

- Train staff on digital literacy to maintain operations remotely if needed.

- Use social media not just for marketing, but for building community trust and gathering real-time market intelligence.

5. Prioritize Stakeholder Trust and Corporate Stewardship

In a fractured society, a business's reputation is its most valuable asset. Treating employees fairly, even when times are tough, builds loyalty and reduces turnover. Honoring commitments to suppliers and customers, even at a short-term loss, strengthens the trust networks that are critical for survival. Engaging in community support can also enhance brand equity and social license to operate.

Practical Checklist for Afghan Business Leaders

- Conduct a Core Viability Audit: Identify which 20% of your products/services generate 80% of your revenue. Focus resources there.

- Diversify Revenue Streams: Explore at least one new, essential good or service that complements your core business.

- Formalize Hawala Relationships: Document transactions with your hawaladar clearly, even informally. Have a backup hawaladar.

- Explore Islamic Finance Models: Research Murabaha and Mudaraba structures for your next equipment purchase or expansion project.

- Go Digital: Create a business WhatsApp/Telegram channel for customer orders and updates. Use a simple spreadsheet for inventory tracking.

- Build a Local Supply Network: Identify at least two local suppliers for critical inputs to reduce import dependency.

- Strengthen Community Ties: Allocate a small portion of resources or time to a local community need. This builds invaluable social capital.

- Develop a Contingency Communication Plan: Have a method (e.g., social media, SMS blast) to quickly communicate with employees and customers during a sudden crisis or lockdown.

- Optimize Your Shopfront: Ensure your signage is clear and your products are displayed invitingly.

- Leverage WhatsApp: Create a broadcast list for your best customers to receive updates on new stock and promotions.

Glossary of Key Terms

Gharar

Excessive uncertainty, risk, or ambiguity in a business contract, which is prohibited in Islamic finance.

Hawala

An informal and trust-based system for transferring money and settling accounts across geographic boundaries without the physical movement of cash.

Import Substitution

An economic strategy focused on replacing foreign imports with domestically produced goods and services.

Islamic Finance

A financial system that operates in accordance with Sharia (Islamic law), characterized by the prohibition of interest (Riba) and speculation (Gharar), and the promotion of risk-sharing and asset-backing.

Mudaraba

A profit-sharing partnership in Islamic finance where one party provides the capital (rab-ul-mal) and the other provides expertise and labor (mudarib). Profits are shared as per a pre-agreed ratio, but financial losses are borne only by the capital provider.

Murabaha

A cost-plus financing structure where a financial institution buys an asset and sells it to a client at a marked-up price, with payment often made in installments. This is a common Sharia-compliant alternative to an interest-based loan.

Musharaka

A joint venture partnership in Islamic finance where all partners contribute capital and share in both profits and losses according to their respective investments.

Riba

An Arabic term meaning "usury" or unjust, exploitative gains made in trade or business, most commonly interpreted as interest. It is strictly forbidden in Islam.

Wasta

An Arabic term referring to the use of influence, social connections, and nepotism to get things done. In the business context, it can mean leveraging personal networks to facilitate transactions and overcome bureaucratic hurdles.

Conclusion: Resilience as a Blueprint

The story of Afghan business is one of extraordinary tenacity. The strategies they have honed—reliance on trust networks, operational agility, the use of alternative systems like hawala, and the integration of Islamic principles—provide a vital blueprint for survival in hyper-volatile environments. While the international community deliberates on political solutions, the Afghan entrepreneur continues to work, adapt, and endure.

Their journey underscores a universal truth: while governments and ideologies may rise and fall, the fundamental human drive to trade, create, and provide for one's family is indomitable. For local businesses, the path forward is not about waiting for stability to return, but about mastering the art of navigating instability itself. By systematizing their innate resilience, Afghan businesses can not only survive the current storms but also lay the groundwork for a more self-reliant and robust economic future.

|

|

| | |